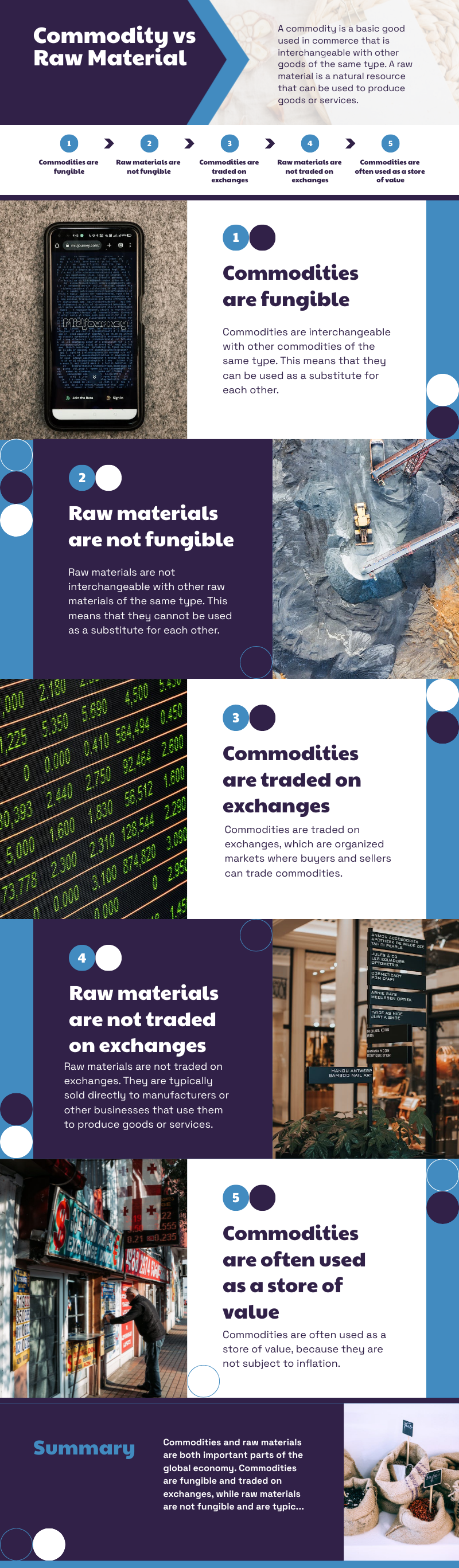

Commodity is a standardized product traded on exchanges. Raw material is an unprocessed substance used in manufacturing or production processes.

Did you know that commodities and raw materials, terms often used interchangeably, have distinct meanings in market dynamics?

Understanding the differences between commodity and raw material is crucial for businesses, investors, and consumers in navigating the supply chain and market dynamics.

Key Takeaways:

- A commodity refers to a finished good traded in the market, while a raw material is the basic substance or material used to create commodities and finished goods.

- Commodities are essential components of the production and manufacturing process, while raw materials are the primary inputs for creating commodities and finished goods.

- Commodities and raw materials play significant roles in the market, connecting producers and consumers through the supply chain.

- Commodities can be traded on exchanges through futures contracts, stocks, and ETFs, while raw materials undergo processing and transformation before becoming commodities or other finished goods.

- Examples of commodities include metals, energy resources, agricultural products, and digital assets, while examples of raw materials include natural resources, chemicals, and agricultural crops.

What is a Commodity?

A commodity is a basic good used as an input in the production of goods and services. It can be a physical product, such as metals, agricultural products, or energy resources, or it can be a service, such as bandwidth or blockchain-based tokens. Commodities are essential components of the manufacturing and production process and are commonly traded on exchanges through futures contracts.

There are different types of commodities, each with its unique characteristics and market dynamics. Here are some examples:

- Metals: Copper, gold, silver

- Agricultural products: Wheat, corn, coffee beans

- Energy resources: Crude oil, natural gas

- Services: Bandwidth, blockchain-based tokens

The commodity market plays a significant role in the global economy. It provides a platform for buying and selling commodities, allowing producers, consumers, and investors to participate in commodity trading. The prices of commodities are influenced by factors such as supply and demand, geopolitical events, and economic conditions.

To better understand the concept of commodities, let’s take a closer look at how they are traded and the dynamics of the commodity market.

| Key Aspects | Details |

|---|---|

| Commodity Trading | Commodities are traded on exchanges through futures contracts, allowing investors to speculate on the future price movements of commodities. |

| Commodity Market | The commodity market facilitates the buying and selling of commodities. It provides a platform for producers, consumers, and investors to connect and trade. |

What is a Raw Material?

A raw material is the primary substance or material used to create commodities and finished goods. It serves as the foundation for the production process in various industries, including manufacturing, construction, and agriculture. Raw materials can be sourced from natural resources or synthesized through chemical processes.

Definition of Raw Material

A raw material is the basic component that undergoes processing and transformation to become a commodity or a finished product. It is the starting point of the supply chain, where value is added through manufacturing and other processes.

Examples of Raw Materials

Raw materials encompass a wide range of substances from different sources. Here are some examples of raw materials used in various industries:

| Industry | Examples of Raw Materials |

|---|---|

| Manufacturing | Iron ore, crude oil, wood, cotton, agricultural crops (corn, soybeans) |

| Construction | Timber, cement, steel, sand, gravel |

| Agriculture | Fertilizers, seeds, water |

| Chemical | Chemicals, polymers, solvents |

Raw Material in Manufacturing

Raw materials play a crucial role in the manufacturing sector. They are the essential components that go into the production of goods. Different industries require specific raw materials to produce a wide variety of products, ranging from automobiles and electronics to clothing and food.

Raw Material Sourcing

Sourcing raw materials involves identifying and acquiring the necessary resources to meet production requirements. This process includes identifying suppliers, negotiating prices, ensuring quality standards, and managing the supply chain to ensure a steady and reliable flow of raw materials to the manufacturing facilities.

Overall, raw materials are the building blocks of the economy, contributing to the creation of commodities and finished goods that shape our daily lives.

The Role of Commodities in the Market

Commodities are crucial in the market as they’re used to make goods and services, connecting producers and consumers. They are traded on exchanges through financial tools like futures contracts. The prices of commodities are affected by factors such as supply and demand, geopolitical events, and economic conditions.

| Factors Influencing Commodity Prices |

|---|

| Supply and demand dynamics |

| Geopolitical events |

| Economic conditions |

Supply and demand for commodities can change due to weather, technology, and trade policies. Natural disasters or geopolitical tensions can disrupt supply, affecting prices. Commodities are not just materials; they’re also investments that diversify portfolios and guard against inflation. Understanding their role and the factors influencing prices is vital for businesses, investors, and policymakers to make informed decisions and manage risks in a global economy.

The Significance of Raw Materials

Raw materials are crucial for making stuff, like cars and electronics. They come from nature and go through processing to become usable. The significance of raw materials lies in their impact on production costs and overall profit for businesses.

In manufacturing, raw materials are like building blocks for creating things in various industries. Without a reliable supply, production stops, causing shortages. Raw materials directly affect production costs. Changes in their prices, due to factors like supply and demand, can impact a company’s profits. To keep things running smoothly, businesses must efficiently source raw materials, build strong supply chains, and reduce the risk of shortages, making them more competitive in the global market.

Distinctions Between Commodity and Raw Material

While commodity and raw material are closely related, there are key distinctions between them.

A commodity refers to the finished or processed product that is traded in the market, while a raw material refers to the basic substance or material that is used to create commodities.

Commodities are often further processed or transformed before being sold to consumers. Raw materials, on the other hand, undergo processing and transformation to become commodities or other finished goods.

Examples of Commodities and Raw Materials

Commodities and raw materials are essential components of the global market. They play a crucial role in various industries, from manufacturing to finance. Let’s explore some examples of commodities and raw materials:

Examples of Commodities

- Metals: Copper, gold, silver

- Energy Resources: Crude oil, natural gas

- Agricultural Products: Wheat, coffee beans, corn, soybeans

- Digital Commodities: Blockchain-based tokens, non-fungible tokens (NFTs)

Examples of Raw Materials

- Metals: Iron ore

- Energy Resources: Crude oil

- Timber: Wood

- Agricultural Products: Cotton

- Chemicals: Used in manufacturing processes

These examples represent just a fraction of the diverse range of commodities and raw materials traded in the market. They are vital for various industries, contributing to economic growth and providing the necessary inputs for the production of goods and services.

| Examples of Commodities | Examples of Raw Materials |

|---|---|

| Copper | Iron ore |

| Gold | Crude oil |

| Silver | Timber |

| Crude oil | Cotton |

| Natural gas | Chemicals used in manufacturing processes |

| Wheat | – |

| Coffee beans | – |

| Corn | – |

| Soybeans | – |

| Blockchain-based tokens | – |

| Non-fungible tokens (NFTs) | – |

Trading and Investment in Commodities

Commodity trading and investment offer opportunities for individuals and organizations to participate in the dynamic world of commodities. Whether it’s through futures contracts, stocks, exchange-traded funds (ETFs), or physical commodities, there are various avenues to engage in the commodity market.

Commodity Trading

Commodity trading involves buying and selling commodities on exchanges. The most common method is through futures contracts, which allow traders to speculate on the future price movements of commodities. These contracts provide a standardized framework for trading and delivery of commodities at a predetermined date and price.

Investors can also trade commodities indirectly through stocks of companies related to the commodity sector. For example, investing in oil and gas companies can provide exposure to the crude oil market. Additionally, exchange-traded funds (ETFs) offer a convenient way to invest in a diversified basket of commodities or commodity-related securities.

Investing in Commodities

Investing in commodities can be achieved not only through trading but also through physical ownership of commodities. Investors can choose to buy and hold physical commodities like gold, silver, or other precious metals. These tangible assets can act as a hedge against inflation and economic uncertainties.

When considering commodity investment, it’s important to be aware that commodity prices can be subject to market volatility. Factors such as supply and demand, global economic conditions, and geopolitical events can significantly influence commodity prices. Therefore, conducting thorough research, understanding market dynamics, and diversifying investments are essential elements for successful commodity investing.

To illustrate the significance of commodity trading and investment, here is an example of one of the oldest commodity exchanges:

| Commodity Exchange | Location |

|---|---|

| Chicago Board of Trade (CBOT) | Chicago, Illinois, United States |

The Chicago Board of Trade (CBOT) is a prominent commodity exchange where agricultural and financial contracts are traded. It provides a platform for market participants to buy and sell various commodities, including grains, livestock, energy products, and financial instruments like Treasury bonds.

Overall, trading and investing in commodities can offer opportunities for diversification, hedging, and potential financial gains, but it requires careful analysis, risk management, and staying informed about market trends and fundamentals.

Value Addition and Differentiation

Commodities, by definition, do not undergo value addition. They are in their raw or basic form and are produced in large quantities with minimal differentiation.

On the other hand, products can be differentiated and value can be added through processing, branding, and marketing. Products are the finished goods that are sold to consumers and can vary in terms of quality, features, and branding.

Value Addition to Commodities

Commodities, such as agricultural crops or metals, are generally produced in large quantities and are traded in standardized forms. They are not typically differentiated through value addition processes.

However, value addition can occur at later stages in the supply chain when commodities are processed into secondary or tertiary products. For example, wheat can be transformed into flour, which can then be further processed into bread or other baked goods. These value-added products have unique characteristics and can command higher prices in the market.

Differentiation of Products

Products, unlike commodities, can be differentiated based on various factors such as quality, features, functionality, design, and branding.

Value can be added to products through differentiating features that meet specific customer needs and preferences. For example, a smartphone can have advanced camera technology, a larger screen size, or unique software applications that set it apart from competitors.

Value-Added Products

Value-added products are those that have undergone additional processing or modification to enhance their value in the market.

These products often offer unique benefits or features that make them more desirable to consumers. Value-added products can command higher prices and create a competitive advantage for businesses. Examples of value-added products include organic food, premium clothing brands, and customized consumer electronics.

By differentiating products and adding value through various means, businesses can stand out in the market and attract customers who are looking for specific features or unique offerings.

| Commodities | Products |

|---|---|

| Produced in large quantities | Customized and tailored to specific customer needs |

| Minimal differentiation | Differentiated through various factors like quality, features, and branding |

| Traded in standardized forms | Offer unique benefits or features |

| Value addition occurs at later stages in the supply chain | Value added through processing, branding, and marketing |

Commodities and Raw Materials in the Digital Age

In the digital age, technology has brought about digital commodities, a fusion of tech and traditional markets. Examples include internet bandwidth, mobile phone minutes, cryptocurrencies, and NFTs.

Internet bandwidth, crucial for data transfer, is in high demand for online activities. Mobile phone minutes, allowing communication, have become valuable assets. Cryptocurrencies, like Bitcoin, offer secure and transparent transactions, gaining attention as investments. NFTs, representing digital ownership, create new ways for artists to monetize their work.

| Digital Commodities | Description |

|---|---|

| Internet Bandwidth | Facilitates data transfer and online activities |

| Mobile Phone Minutes | Allows voice and messaging services on mobile devices |

| Blockchain-based Tokens (Cryptocurrencies) | Digital assets based on decentralized technology |

| Non-fungible Tokens (NFTs) | Represent ownership or proof of authenticity for digital assets |

While these digital commodities open new opportunities, challenges like market volatility and regulatory concerns exist. Understanding their complexities is crucial for individuals, businesses, and investors in the digital age.

Conclusion

Commodities are finished goods traded in the market, while raw materials are the basic substances used to make these goods. Knowing the differences is crucial for businesses, investors, and consumers to navigate the supply chain and market.

Commodities, like metals and digital assets, are vital for production and trade. Their prices depend on supply, demand, and economic factors. Raw materials, on the other hand, are natural resources turned into goods. Efficiently sourcing raw materials is crucial for manufacturing. Understanding these differences helps businesses make smart decisions, allows investors to seize opportunities, and lets consumers know more about the products they buy in our ever-changing market.

FAQ

What is the difference between a commodity and a raw material?

A commodity refers to a finished or processed product that is traded in the market, while a raw material refers to the basic substance or material used to create commodities and finished goods.

Can you provide examples of commodities?

Examples of commodities include metals like copper and gold, energy resources like crude oil and natural gas, agricultural products like wheat and coffee beans, and digital commodities like blockchain-based tokens and NFTs.

What are some examples of raw materials?

Examples of raw materials include iron ore, crude oil, timber, cotton, agricultural crops like corn and soybeans, and chemicals used in manufacturing processes.

How are commodities traded in the market?

Commodities can be traded on exchanges through futures contracts, stocks of related companies, or through exchange-traded funds (ETFs).

What is the role of commodities in the market?

Commodities are essential components of the manufacturing and production process and are commonly traded on exchanges. They serve as inputs for the production and manufacturing of goods and services and are influenced by factors like supply and demand, geopolitical events, and economic conditions.

Why are raw materials significant in manufacturing?

Raw materials are crucial for manufacturing as they provide the necessary inputs for the production of commodities and finished goods. The availability and cost of raw materials can significantly impact the production costs and profitability of businesses.

What are the key distinctions between commodity and raw material?

A commodity refers to the finished or processed product that is traded in the market, while a raw material refers to the basic substance or material that is used to create commodities. Commodities are often further processed or transformed before being sold to consumers. Raw materials undergo processing and transformation to become commodities or other finished goods.

Can you explain the concept of value addition and differentiation?

Commodities, by definition, do not undergo value addition. They are in their raw or basic form and are produced in large quantities with minimal differentiation. On the other hand, products can be differentiated and value can be added through processing, branding, and marketing.

How are commodities and raw materials impacted by digital advancements?

With the advent of information technology and computing, digital commodities have emerged, including internet bandwidth, mobile phone minutes, blockchain-based tokens like cryptocurrencies, and NFTs. These digital assets have become valuable and tradable in the digital age, representing a new form of commodity and raw material in the market.

Source Links

- https://www.investopedia.com/ask/answers/021615/whats-difference-between-commodity-and-product.asp

- https://hinative.com/questions/22228170

- https://forum.wordreference.com/threads/commodity-vs-raw-material.2075647/

Image Credits

Featured Image By – macrovector_official on Freepik

Image 1 By – user15245033 on Freepik

Image 2 By – pch.vector on Freepik