The difference between Stocks and bonds is that stocks represent ownership in a company and provide the potential for capital appreciation and dividends, while bonds represent debt that an investor lends to an entity in exchange for regular interest payments and the return of the principal investment at maturity. Stocks are generally considered to be riskier but offer higher potential returns, while bonds are generally considered to be less risky but offer lower potential returns.

What are stocks?

(Image by Ahmad Ardity from Pixabay )

A stock is a share of ownership in a company. When you buy stock, you become a partial owner of the company with a claim on the company’s assets and earnings. As an owner, you are entitled to vote on corporate matters and receive dividends.

What are bonds?

Bonds are debt instruments used by companies to raise capital. When you buy a bond, you are lending money to the issuing company. In return, the company promises to pay you interest payments (coupons) and return your principal when the bond matures.

Stocks Vs. Bonds – Key differences

Stocks and bonds are two different types of investments with different characteristics and risks. Some key differences between stocks and bonds are:

Ownership: Stocks represent ownership in a company, while bonds represent a debt that an investor lends to an entity.

Risk and return: Stocks are generally considered to be riskier than bonds, but they offer the potential for higher returns. Bonds are generally considered to be less risky than stocks, but they offer lower returns.

Income: Stocks may provide income in the form of dividends, while bonds provide regular interest payments.

Maturity: Stocks do not have a maturity date, while bonds have a specific maturity date when the principal investment is returned to the investor.

Volatility: The value of stocks can be volatile, as it can be affected by a wide range of factors such as market conditions and company performance. Bonds are generally less volatile.

Liquidity: Stocks are more liquid than bonds, as they can be bought and sold more easily.

Role in a portfolio: Stocks are often used for growth and capital appreciation, while bonds are often used for income and capital preservation.

Stocks and bonds have different characteristics, risks, and potential rewards. Investors may choose to invest in one or both depending on their investment objectives and risk tolerance.

How to choose the right investment for you

When it comes to making investment choices, there are a lot of things to consider. But ultimately, the decision comes down to what you’re looking for in an investment. Are you looking for stability and income? Or are you willing to take on more risk for the potential of higher returns?

Here’s a quick rundown of stocks and bonds to help you make the right choice for your portfolio:

Stocks:

- Stocks represent ownership in a company.

- When you buy stock, you become a part owner of that company and have a claim on its assets and earnings.

- Stocks tend to be more volatile than bonds, which means they can go up or down in value more quickly. But over the long term, stocks have historically outperformed bonds.

- If you’re looking for growth potential, stocks are a good choice. But keep in mind that there is more risk involved.

Bonds:

- Bonds are loans that investors make to corporations or governments.

- In exchange for lending money, the borrower agrees to pay interest on the loan and repay the principal when the bond matures.

- Bonds tend to be less volatile than stocks, which means their value doesn’t fluctuate as much. This makes them a good choice if you’re looking for stability and income.

- However, because they’re not as risky as stocks, bonds typically provide lower returns over time.

What pays more stocks or bonds?

Stocks generally have the potential to pay more than bonds, but they also carry more risk. Stocks are equity investments, which means that investors own a portion of the company and may benefit from capital appreciation, dividends, and other potential earnings. The value of stocks can fluctuate greatly and there is no guarantee of a return on investment.

On the other hand, bonds are debt investments and typically offer lower potential returns than stocks but are generally considered to be less risky. Bond investors receive regular interest payments until the bond matures, at which point the principal is returned. The return on investment for bonds is usually fixed, and there is a lower risk of losing the principal investment.

In summary, stocks have the potential to pay more than bonds, but this potential reward comes with a greater risk of loss. Investors should carefully consider their investment objectives and risk tolerance when deciding between stocks and bonds.

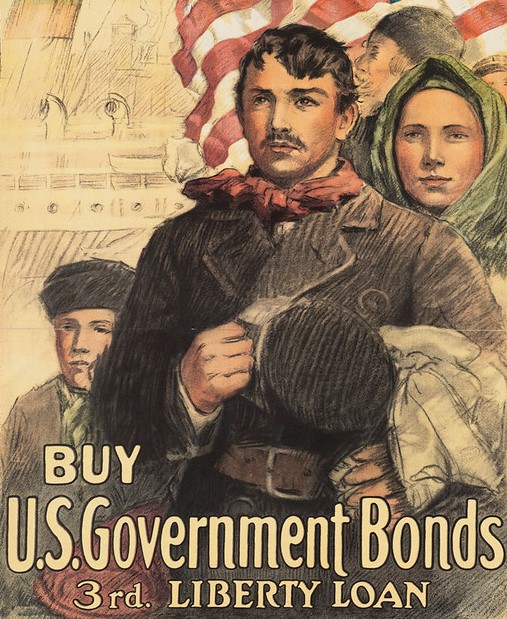

What are the types of bonds?

(Photo By Boston Public Library on Flickr)

There are four types of bonds: Corporate bonds, Government bonds, Municipal bonds, and Treasury bonds.

Corporate bonds are issued by companies to raise money for business purposes.

Government bonds are issued by national governments to finance projects such as infrastructure development.

Municipal bonds are issued by local governments to finance projects such as schools and roads.

Treasury bonds are issued by the US government to finance the national debt.

Is bond safer than stock?

Bonds are often considered to be a safer investment than stocks, because they are less volatile and tend to provide a steadier stream of income. When the stock market is down, bond prices usually go up. This is because investors are looking for stability and safety during times of economic uncertainty.

Of course, there is no such thing as a completely safe investment, and bonds are not immune to market fluctuations. But overall, they tend to be less risky than stocks. That being said, bonds also typically offer lower returns than stocks over the long term. So if you’re looking for growth potential, stocks may be a better choice.

What are the advantages and disadvantages of stocks?

Advantages of stocks:

- Potential for high returns: Stocks have the potential for high returns over the long term, which can help investors grow their wealth.

- Ownership in a company: When you buy stocks, you own a portion of the company and have a say in its decision-making process.

- Dividend income: Some stocks pay dividends, which provide investors with a regular income stream.

- Liquidity: Stocks are easily bought and sold, making them a highly liquid investment.

- Diversification: Stocks allow investors to diversify their portfolio by investing in different sectors or industries.

Disadvantages of stocks:

- Volatility: Stocks can be highly volatile, with prices that can fluctuate rapidly and unpredictably.

- Risk: There is no guarantee of a return on investment, and stocks can carry a high level of risk, especially for individual stocks.

- No fixed income: Unlike bonds, stocks do not provide a fixed income stream, which can make them less attractive to income-seeking investors.

- Emotional investing: The volatility of stocks can lead investors to make emotional decisions, which can result in losses.

- Limited control: As a shareholder, you have limited control over the company’s decision-making process, and your investment returns are subject to the company’s performance and management decisions.

Stocks can provide a potentially high return on investment, but they also carry a higher level of risk than other types of investments. Investors should carefully consider their investment objectives and risk tolerance before investing in stocks, and should diversify their portfolio to minimize risk.

What are the advantages and disadvantages of bonds?

Advantages of bonds:

- Fixed income: Bonds provide a fixed income stream, which can be attractive to investors who want a predictable income.

- Less volatility: Bonds are generally less volatile than stocks, which can make them a more stable investment option.

- Diversification: Bonds allow investors to diversify their portfolio by investing in different types of bonds with varying risk levels and maturities.

- Safety of principal: If held to maturity, bonds provide a guaranteed return of principal, which can provide a level of safety for investors.

- Higher priority in bankruptcy: In the event of a company’s bankruptcy, bondholders have a higher priority than stockholders to receive payments.

Disadvantages of bonds:

- Lower potential returns: Bonds typically offer lower potential returns than stocks, which can make them less attractive to investors seeking higher returns.

- Interest rate risk: When interest rates rise, bond prices typically fall, which can negatively impact the value of a bond portfolio.

- Inflation risk: The fixed income provided by bonds may not keep up with inflation, which can erode the purchasing power of the investment over time.

- Credit risk: There is a risk that the issuer of a bond may default on the bond payments, which can result in a loss of principal and interest for investors.

- Less liquidity: Bonds can be less liquid than stocks, making them more difficult to buy and sell, especially in the case of individual bonds.

Bonds can provide a stable income stream and a level of safety for investors, but they also carry risks such as interest rate and credit risk. Investors should carefully consider their investment objectives and risk tolerance before investing in bonds, and should diversify their portfolio to minimize risk.

Featured Image By – Mediamodifier from Pixabay