A feasibility study is an analysis of whether a business idea is practical and viable, while a business plan outlines the strategy and operations of a business in detail. Essentially, a feasibility study is a precursor to a business plan, helping to determine whether the business idea is worth pursuing before investing time and resources into developing a full plan.

What is a feasibility study?

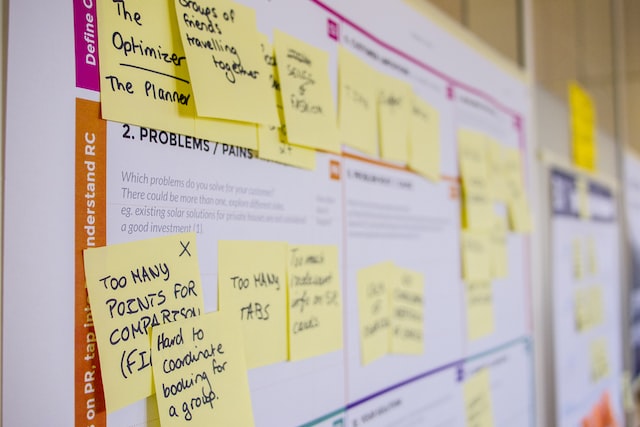

(Photo by Firmbee.com on Unsplash )

A feasibility study is an analysis of the viability of an idea, proposal, or concept. It assesses the likelihood that a project will be successful in meeting its objectives and goals, and whether it is worth pursuing.

A feasibility study is not the same as a business plan. A business plan is a document that outlines the financial and operational goals of a business. It includes information on the company’s products or services, marketing strategy, and target market.

A feasibility study looks at all aspects of a proposed project, including technical feasibility, financial feasibility, and operational feasibility. It is used to determine whether a project is worth pursuing and to identify any potential risks or limitations.

Technical feasibility looks at whether a proposed project can be completed with the available resources. This includes evaluating the technical requirements, such as hardware and software requirements, and assessing whether these can be met. Financial feasibility looks at whether a proposed project is financially viable. This includes assessing the costs and benefits of the project, as well as any potential sources of funding. Operational feasibility looks at whether a proposed project can be completed successfully within the given constraints. This includes evaluating the resources required for the project and assessing whether they are available.

The goal of a feasibility study is to identify any potential problems with a proposed project so that they can be addressed before moving forward. By doing this, it increases the chances of success for the project overall.

What is a business plan?

(Photo by Jason Goodman on Unsplash )

A business plan is a comprehensive document that outlines the strategy, operations, and financial projections for a business. It typically includes information on the company’s products or services, target market, competition, marketing and sales strategies, management team, and financial projections.

A well-written business plan is an important tool for entrepreneurs and business owners, as it provides a roadmap for the future of the business and helps to secure funding from investors or lenders. It allows the business owner to clearly articulate their vision and goals, and to identify potential challenges and opportunities.

The key components of a business plan typically include an executive summary, company description, market analysis, marketing and sales strategy, management and organization, product or service line, financial projections, and funding request.

The executive summary provides an overview of the business plan, highlighting the key points and objectives. The company description provides background information on the business, including its history, mission, and goals. The market analysis outlines the target market, competition, and industry trends. The marketing and sales strategy describes how the business will reach and engage customers. The management and organization section details the management team and organizational structure of the business. The product or service line outlines the products or services the business will offer. The financial projections include income statements, balance sheets, and cash flow statements. Finally, the funding request outlines the amount of funding needed and how it will be used.

Overall, a business plan is a critical document for any business, providing a roadmap for success and a way to attract funding and support from investors and lenders.

The key differences between a feasibility study and a business

Purpose: A feasibility study is conducted to determine whether a business idea is practical and viable, while a business plan is developed to outline the strategy, operations, and financial projections for a business.

Scope: A feasibility study is a preliminary analysis that focuses on the market, technical, and financial feasibility of a business idea, while a business plan is a comprehensive document that covers all aspects of a business, including its products or services, target market, competition, marketing and sales strategies, management team, and financial projections.

Timing: A feasibility study is typically conducted before developing a business plan to determine whether the business idea is worth pursuing, while a business plan is developed once the decision to proceed with the business has been made.

Audience: A feasibility study is primarily used to inform the entrepreneur or management team about the viability of the business idea, while a business plan is used to secure funding from investors or lenders.

Level of detail: A feasibility study provides a high-level analysis of the business idea, while a business plan provides a detailed roadmap for the future of the business, including its marketing and sales strategies, management team, and financial projections.

When to use a feasibility study Vs. A business plan

A feasibility study is typically used when starting a new business or venture, and its purpose is to determine if the proposed business idea is viable. A feasibility study will assess the market potential, technical feasibility, and financial viability of the proposed business. It is important to note that a feasibility study is not the same as a business plan; rather, it is one tool that can be used in developing a business plan.

In contrast, a business plan is typically used once a business has already been established. Its purpose is to outline the company’s strategy for achieving its goals and objectives. Unlike a feasibility study, which assesses the viability of a proposed idea, a business plan focuses on an existing businesses’ ability to execute its strategy and achieve its goals.

How to create a feasibility study

A feasibility study is an analysis of whether a proposed project is likely to be successful. A business plan is a more detailed document that outlines the specifics of the business, such as its products or services, marketing strategy, and financial projections.

Creating a feasibility study typically requires four main steps:

- Define the problem or opportunity. This step includes understanding the needs of the potential customer or client.

- Research and gather data. This step includes secondary research, such as market analysis and industry trends, as well as primary research, such as customer surveys or interviews.

- Analyze the data and make recommendations. This step includes determining whether the problem or opportunity can be solved and whether the proposed project is likely to be successful.

- Prepare a written report. This step includes documenting the findings of the feasibility study in a clear and concise manner.

How to create a business plan

Creating a business plan can seem like a daunting task, but it doesn’t have to be. You can start by doing some research and then outlining your goals and objectives. Once you have a good understanding of what you want to achieve, you can start putting together a more detailed plan.

There are a few key things that should be included in any business plan:

- An executive summary. This is a brief overview of your business and what you hope to accomplish.

- A description of your product or service. What are you offering and why do your customers need it?

- A marketing plan. How will you reach your target market and what strategies will you use to promote your product or service?

- A financial plan. What are your revenue and expense projections? How much money do you need to get started or to keep your business running?

- An operational plan. What are the day-to-day details of running your business? Who will handle what tasks?

- A risk management plan. What could go wrong and how will you handle it if it does?

What are the types of feasibility studies?

Market Feasibility

A market feasibility study assesses the potential for a product or service to be successful in a given market. It takes into account multiple factors such as the size of the target market, growth trends, competitor analysis, and customer needs and buying habits. This type of feasibility study is important for businesses to understand whether there is a demand for their product or service in the marketplace.

Technical Feasibility

A technical feasibility study assesses the ability of a business to successfully develop and implement a proposed solution. This includes assessing the technical risks involved, as well as ensuring that the necessary resources (e.g., personnel, equipment) are available. A technical feasibility study is important to determine whether a proposed solution is achievable and will meet the needs of the business.

Financial Feasibility

A financial feasibility study assesses the potential financial impact of a proposed solution. This includes an assessment of the costs and benefits of implementing the solution, as well as any potential risks and uncertainties associated with it. A financial feasibility study is important to determine whether a proposed solution is financially viable and will have a positive impact on the business’s bottom line.

Managerial Feasibility

A managerial feasibility study assesses the ability of management to successfully develop and implement a proposed solution. This includes an assessment of management’s experience, skills,

What are the types of business plans?

There are three types of business plans:

Internal business plan

An internal business plan is a document that outlines the company’s strategy for achieving its objectives. It is typically created by the company’s management team and is not shared with outsiders.

External business plan

An external business plan is a document that is shared with outsiders, such as investors, potential partners, and customers. Its purpose is to persuasively communicate the company’s strategy and how it will achieve its objectives.

Hybrid business plan

A hybrid business plan combines elements of both an internal and an external business plan. It typically includes a high-level overview of the company’s strategy that can be shared with outsiders, as well as more detailed information on operational matters that is meant for internal use only.

Featured Image By – Photo by Daria Nepriakhina 🇺🇦 on Unsplash