Class A shares typically have voting rights and higher fees, while Class B shares may have lower fees but fewer voting rights and longer holding periods.

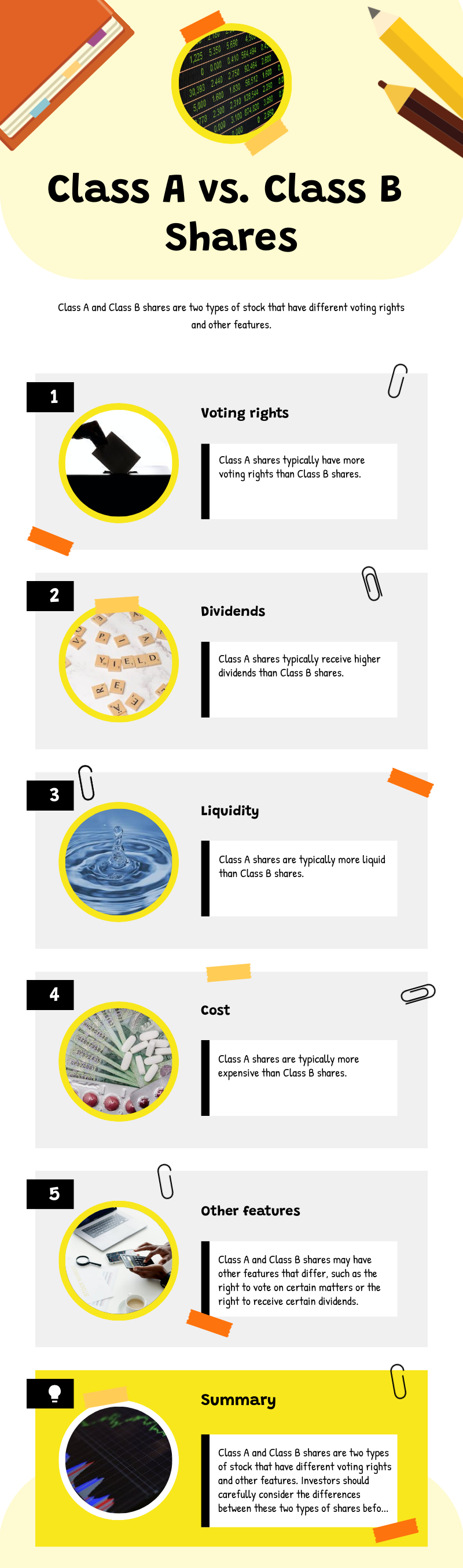

Did you know that the choice between Class A and Class B shares can have a significant impact on your voting power as a shareholder? Understanding the differences between Class A and Class B shares is essential for investors looking to make informed decisions about their investments. While both share classes represent ownership in a company, they come with distinct characteristics and benefits that can influence your investment strategy. Whether you’re a seasoned investor or just starting, knowing the nuances of Class A and Class B shares is crucial.

Key Takeaways:

- Class A shares usually offer more voting power compared to Class B shares.

- Class A shares are often held by management to retain control of the company.

- Class B shares generally have lower voting rights but are priced lower, making them more accessible to a wider range of investors.

- Both Class A and Class B shareholders have the right to share in company profits through dividends.

- Conversion options and ownership restrictions can vary between Class A and Class B shares.

Class A Shares

Class A shares are a type of common stock that gives ownership in a company. They usually come with more voting rights than other stocks, allowing shareholders to have a say in company decisions like electing board members or approving mergers. Additionally, Class A shareholders can convert their shares into common stock if the company is sold, potentially increasing their investment value.

These shares are often reserved for company executives and managers, showing their leadership roles. This exclusivity can give shareholders a sense of prestige. Overall, Class A shares offer higher voting power, conversion options, and a sense of belonging to top-level management within the company.

Table:

| Benefits of Class A Shares |

|---|

| Higher voting rights |

| Conversion to common stock |

| Reserved for management and executives |

Class B Shares

When a company offers more than one class of stock, Class B shares are designated as common stocks that typically have fewer voting rights compared to Class A shares. Unlike Class A shares, which often grant greater voting power to shareholders, Class B shares may offer lower voting rights per share, depending on how the company structures its stock. Additionally, Class B shares are lower in payment priority than Class A shares, meaning in the event of bankruptcy or liquidation, Class A shareholders would be paid out first.

However, Class B shares also offer certain benefits. They are often issued at a lower price, making them more accessible to a wider range of investors. This lower price can attract investors who are looking for a more affordable entry point into investing in a particular company. Furthermore, Class B shares may also provide investors with an opportunity to gain exposure to the company’s growth potential.

To illustrate the differences between Class A and Class B shares, let’s take a look at a comparison table:

| Categories | Class A Shares | Class B Shares |

|---|---|---|

| Voting Rights | Typically greater | Fewer compared to Class A |

| Payment Priority | Higher | Lower than Class A |

| Price | Often higher | Lower than Class A |

| Accessibility | Restricted to executives | More accessible to wider range of investors |

As seen in the table, Class B shares offer a more affordable entry point, but typically come with fewer voting rights and lower payment priority compared to Class A shares. Investors should carefully consider these differences when evaluating whether to invest in Class B shares.

Voting Rights and Dividends

The main distinction between Class A and Class B shares is the difference in voting rights. Class A shareholders generally have more voting power compared to Class B shareholders, which allows them to have a greater influence on company decisions and elections of board members.

When it comes to dividends, both Class A and Class B shareholders have the right to share in company profits. The board of directors determines the approved dividends, and shareholders of all classes have an equal right to receive them, although preferred shareholders often receive priority.

| Class A Shares | Class B Shares | |

|---|---|---|

| Voting Rights | Generally higher | Generally lower |

| Dividend Rights | Equal right to receive dividends | Equal right to receive dividends |

| Priority for preferred shareholders |

As seen in the table above, Class A shares usually have higher voting rights compared to Class B shares. This provides Class A shareholders with greater voting power, allowing them to participate more actively in company decision-making processes. Both Class A and Class B shareholders, however, have equal rights to receive dividends, although preferred shareholders may receive priority.

Conversion and Ownership Restrictions

Class A shares have a special feature: they can be converted into common stock, which can be really helpful, especially if the company is being sold. This conversion lets shareholders benefit from the higher value that might come with the sale.

But not everyone can get Class A shares. Some companies only let executives and top-level managers have them. This rule, called ownership restrictions, is to make sure that important people in the company can stay in control and make big decisions.

So, converting Class A shares can be a good move during big changes, like a company sale. And by limiting who can have these shares, companies can make sure that the people running the show are really invested in the company’s success.

| Benefits | Conversion of Class A Shares | Ownership Restrictions |

|---|---|---|

| 1. Increased potential return for Class A shareholders. | 1. Conversion allows Class A shareholders to benefit from combined share price in specific situations. | 1. Ownership restrictions limit Class A shares to executives and c-suite. |

| 2. Aligns interests of management with long-term success of the company. | 2. Conversion can incentivize executives to make strategic decisions. | 2. Ensures those in leadership positions maintain control and decision-making power. |

| 3. Provides flexibility for executives to exercise their voting power. | 3. Promotes commitment and accountability among executives. |

Market Capitalization and Share Classes

The market capitalization of a company is determined by the sum of all classes of shares. This means that both Class A and Class B shares contribute to the overall market value of the company. The value of each share class may vary based on factors such as voting rights, dividend access, and ownership restrictions. Share classes are created by companies to meet specific objectives, such as maintaining control and attracting different types of investors.

Preferred Stock and Class Shares

When it comes to investing in stocks, it’s essential to understand the difference between preferred stock and class shares. While both represent ownership in a company, they have distinct characteristics and benefits.

Preferred Stock:

Preferred stock is a unique asset class that combines features of both stocks and bonds. It typically offers investors a fixed dividend payment and higher priority in receiving dividends and repayment of assets in the event of liquidation. Preferred shareholders enjoy a preferred status over common shareholders when it comes to distributing company profits.

Class Shares:

Class shares, on the other hand, represent ownership in a company and give shareholders voting rights and a share of the company’s profits. Class shares are often categorized as Class A and Class B, with Class A shareholders usually having more voting power compared to Class B shareholders. Companies may designate different rights and privileges to each class of shares.

Preferred Stock vs. Class Shares: Key Differences

There are several key differences between preferred stock and class shares:

- Dividend Priority: Preferred stockholders have priority over common shareholders in receiving dividend payments. In contrast, class shares are subject to equal rights in dividend distribution.

- Voting Rights: Preferred stockholders generally do not have voting rights in company matters, while class shares provide the opportunity to vote in key decisions.

- Asset Repayment Priority: In the event of liquidation, preferred stockholders have priority in receiving repayment of their investments before common shareholders. Class shares do not have a priority status in asset repayment.

Overall, preferred stock is often favored by conservative investors seeking a steady income supplement, while class shares can provide both ownership and voting rights in the company.

| Preferred Stock | Class Shares |

|---|---|

| Offers fixed dividend payments | Provides voting rights |

| Prioritized in dividend distribution | Subject to equal rights in dividend distribution |

| Prioritized in asset repayment in liquidation | No priority in asset repayment in liquidation |

Company Examples: Berkshire Hathaway

Berkshire Hathaway, the company led by Warren Buffett, serves as an excellent example showcasing the distinctions between Class A and Class B shares. By analyzing Berkshire Hathaway’s share structure, investors can gain a deeper understanding of the differences and benefits associated with each class of shares.

Berkshire Hathaway Class A Shares

Berkshire Hathaway’s Class A shares are known for their significantly higher value per share compared to Class B shares. These shares provide shareholders with greater voting power, allowing them to have a stronger influence on the company’s decision-making process. Warren Buffett and other Berkshire Hathaway executives primarily hold Class A shares, ensuring that they can exert control over the company’s operations and strategic direction.

Berkshire Hathaway Class B Shares

In contrast, Berkshire Hathaway’s Class B shares have reduced voting power but offer a lower price per share, making them more accessible to a wider range of investors. Class B shares were introduced to enable smaller investors to participate in Berkshire Hathaway’s success and access the company’s stock without the financial barrier presented by Class A shares. While shareholders of Class B shares have less voting power, they still maintain the ability to participate in company decisions and receive dividends.

To encapsulate the key differences:

- Berkshire Hathaway Class A Shares: Higher value per share, greater voting power, typically reserved for company executives, provides control over decision-making.

- Berkshire Hathaway Class B Shares: Lower price per share, reduced voting power, accessible to smaller investors, still allows participation in company decisions and dividends.

Now let’s take a closer look at the historical context and significance of Berkshire Hathaway’s share structure.

Dual Class Shares and Governance Issues

Dual class shares, which grant different voting rights to different shareholders, can create governance challenges within a company. Critics express concerns that certain shareholders may wield disproportionate power relative to their economic stake, potentially undermining accountability and transparency. However, supporters of dual class structures argue that they can enhance company performance and sustainability by attracting investors with varied levels of engagement and fostering long-term commitment.

To navigate these concerns effectively, companies employing dual class shares must prioritize a balance between maintaining control and upholding shareholder accountability. Implementing measures to address governance issues, such as enhancing transparency and shareholder engagement, can help mitigate potential drawbacks associated with dual class structures while maximizing their benefits for the company and its stakeholders.

Accountability and Transparency

One of the governance concerns related to dual class shares is the potential for reduced accountability and transparency. With disproportionate voting power in the hands of a select few, decisions made by these shareholders may not be in the best interests of the company or its other shareholders.

To address this issue, it is crucial for companies with multiple share classes to prioritize transparency and establish strong mechanisms for shareholder engagement. Regular reporting, open communication channels, and independent oversight can help mitigate the risk of governance issues and maintain the trust of all stakeholders.

Board Composition and Independence

The composition of a company’s board of directors plays a crucial role in ensuring effective governance. However, when multiple share classes are present, the influence of certain shareholders might limit the independence and diversity of the board.

Companies should strive to have a diverse and independent board that represents the interests of all shareholders. By including directors with varied backgrounds and perspectives, companies can foster robust discussions and decision-making processes that consider the needs of all stakeholders.

Shareholder Rights and Protections

Another concern associated with dual class shares is the potential disregard for minority shareholder rights. With certain shareholders wielding significant voting power, the voices of minority shareholders may be marginalized.

Companies should adopt measures to protect minority shareholder rights, such as implementing safeguards against oppressive actions by controlling shareholders. These safeguards can include mechanisms to ensure fair treatment of all shareholders and provisions for dissenting rights and legal remedies.

The Complexity of Multiple Classes

The presence of multiple share classes can make the corporate structure more complex, potentially leading to confusion and challenges in corporate decision-making.

Companies must ensure that the benefits gained from issuing multiple share classes outweigh the potential drawbacks and complexities. Clear and transparent communication regarding the rights and privileges associated with each class of shares is vital to maintaining understanding and trust among shareholders.

In conclusion, while dual class shares can provide benefits such as control retention and flexibility, it is crucial for companies to address governance concerns associated with multiple share classes. Implementing measures to enhance accountability, transparency, and shareholder rights can help strike a balance between control and corporate governance.

| Issue | Concerns | Solutions |

|---|---|---|

| Accountability and Transparency | Reduced accountability and transparency due to disproportionate voting power. | Prioritize transparency, regular reporting, and independent oversight. Establish strong mechanisms for shareholder engagement. |

| Board Composition and Independence | Potential limitation of board independence and diversity due to the influence of certain shareholders. | Strive for a diverse and independent board. Include directors with varied backgrounds and perspectives. |

| Shareholder Rights and Protections | Potential disregard for minority shareholder rights. | Adopt measures to protect minority shareholder rights. Implement safeguards against oppressive actions by controlling shareholders. |

| The Complexity of Multiple Classes | Increased complexity in corporate decision-making. | Ensure clear and transparent communication regarding the rights and privileges associated with each class of shares. |

Conclusion

In summary, when it comes to Class A and Class B shares, the key difference lies in the voting rights allocated to shareholders. Class A shares typically offer higher voting power and priority in receiving dividends, making them more attractive to those seeking greater control and influence in a company. On the other hand, Class B shares are more common and may have lower voting rights, providing a more accessible entry point for a wider range of investors. The choice between investing in Class A or Class B shares ultimately depends on individual preferences and investment goals.

Before making any investment decisions, it is crucial for investors to thoroughly understand the specific terms and variations associated with each share class. By conducting comprehensive research and consulting with a financial advisor, individuals can make informed choices that align with their investment strategies and objectives.

FAQ

What is the difference between Class A and Class B shares?

The primary difference lies in the voting rights assigned to shareholders. Class A shares typically have more voting power than Class B shares.

What are Class A shares?

Class A shares are common stocks that represent ownership in a company and usually come with more voting rights compared to other classes of stock.

What are Class B shares?

Class B shares are common stocks that usually have fewer voting rights compared to Class A shares. They are designated as such when a company offers more than one class of stock.

How do voting rights and dividends differ between Class A and Class B shares?

Class A shareholders generally have more voting power compared to Class B shareholders. When it comes to dividends, both classes have an equal right to receive them, although preferred shareholders may have priority.

Can Class A shares be converted into common stock?

Yes, in certain situations such as a sale of the company, Class A shares can be converted into common stock, allowing shareholders to benefit from the combined share price.

Are there any ownership restrictions on Class A shares?

Some companies impose ownership restrictions on Class A shares, limiting them to executives and those in the c-suite. These restrictions help maintain control and decision-making power.

How do Class A and Class B shares contribute to the market capitalization of a company?

Both Class A and Class B shares contribute to the overall market value or market capitalization of a company. The value of each share class may vary based on factors such as voting rights, dividend access, and ownership restrictions.

What is the difference between preferred stock and class shares?

Preferred stock combines characteristics of both stocks and bonds and offers priority in receiving dividends and repayment of assets. Class shares represent ownership in a company with voting rights and a share of profits.

Can you provide an example of the difference between Class A and Class B shares?

Berkshire Hathaway offers an example where Class A shares have higher value and more voting power compared to Class B shares, allowing for different types of investors to access the company’s stock.

What are dual class shares and are there any governance concerns?

Dual class shares offer different voting rights to different shareholders, which can raise governance concerns as it may reduce accountability within the company. However, proponents argue that it can enhance performance and provide flexibility for public companies.

Source Links

- https://www.investopedia.com/ask/answers/062215/what-difference-between-class-shares-and-other-common-shares-companys-stock.asp

- https://www.sofi.com/learn/content/classes-of-stock-shares/

- https://smartasset.com/financial-advisor/class-a-shares

Image Credits

Featured Image By – Markus Winkler from Pixabay

Image 1 By – Sergei Tokmakov, Esq. https://Terms.Law from Pixabay

Image 2 By – Sergei Tokmakov, Esq. https://Terms.Law from Pixabay