The main difference between mergers and acquisitions is that in a merger, two companies combine to form a new company, while in an acquisition, one company buys another and absorbs it into its existing business. While there are many reasons why companies engage in M&A activity, the most common goal is to increase market share or expand into new markets.

What is a merger?

(Photo by Dylan Gillis on Unsplash)

A merger is a corporate strategy in which two companies combine forces to achieve mutual objectives. The main objective of a merger is to create shareholder value by combining the two companies’ complementary resources and capabilities. Mergers can be either friendly or hostile, but usually involve some level of negotiation between the two parties.

There are several types of mergers, but the most common are horizontal mergers, in which two companies that compete in the same market combine forces, and vertical mergers, in which two companies that are part of the same supply chain join together.

Mergers can also be classified based on whether they are stock or asset transactions. In a stock transaction, each company’s shareholders receive new shares in the combined company in exchange for their old shares. In an asset transaction, the shareholders of one company receive cash or assets from the other company in exchange for their shares.

What is an acquisition?

An acquisition occurs when one company purchases another. The acquiring company typically assumes control of the acquired company and its assets, though the acquired company may continue to operate independently to some degree. Acquisitions are usually finalized through a purchase agreement or asset purchase agreement.

Mergers Vs. Acquisitions – Key differences

The key difference between a merger and an acquisition is that in a merger, both companies agree to combine forces, while in an acquisition, one company buys out the other. Acquisitions can be either friendly or hostile, but usually involve some level of negotiation between the two parties. The main objective of an acquisition is to grow shareholder value by acquiring another company’s resources and capabilities. There are several types of acquisitions, but the most common are hostile takeovers, in which one company tries to buy out another without its consent; leveraged buyouts, in which a private equity firm takes over a public company using debt.

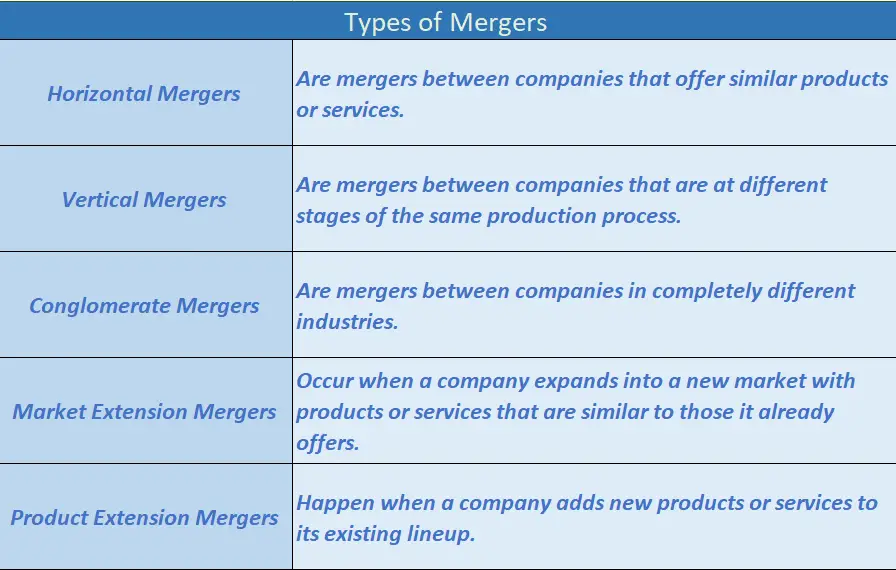

What are the types of mergers?

1. Horizontal Mergers: A horizontal merger is when two companies that offer similar products or services combine forces. The goal of a horizontal merger is to increase market share and eliminate competition between the two companies.

2. Vertical Mergers: A vertical merger occurs when two companies that are at different stages of the same supply chain join forces. The goal of a vertical merger is to create efficiencies and economies of scale by eliminating duplicative activities and consolidating resources.

3. Conglomerate Mergers: A conglomerate merger occurs when two companies that operate in completely different industries come together. The goal of a conglomerate merger is to diversify the company’s product offerings and customer base, which can reduce risk in the event that one industry hits a downturn.

4. Asset Acquisitions: An asset acquisition is when a company buys another company’s assets, but not the whole company. The goal of an asset acquisition is usually to acquire tangible assets, like property or equipment, or intangible assets, like patents or copyrights.

5. Management Buyouts: A management buyout (MBO) is when the management team of a company buys out the company from its current owner(s). The goal of an MBO is usually to take the company private so that the management team has more control over strategic decisions without having to answer to public shareholders.

How to decide if a merger or acquisition is right for your business

The first is to take a look at your company’s overall financial health and see if there are any areas that could be improved upon. If your company is struggling in certain areas, then acquiring another company may help to turn things around.

Another factor to consider is whether or not you have the time and resources to dedicate to a merger or acquisition. These types of deals can take months or even years to complete, so you need to make sure you have the manpower and financial resources in place to see it through.

Finally, you need to ask yourself if a merger or acquisition makes sense strategically for your business. Do the two companies complement each other well? Will the deal help you gain market share or enter new markets? Weigh all of these factors carefully before making a decision; a wrong move here could cost your business dearly down the road.

Who benefits from mergers and acquisitions?

There are many potential benefits that can result from a merger or acquisition. Firstly, the enlarged company may be able to achieve cost savings by eliminating duplicate functions or consolidating operations. Secondly, the new company may be able to achieve revenue growth by expanding into new markets or selling complementary products and services. Finally, the merged company may have greater financial strength and flexibility, which can help it weather tough economic times or take advantage of opportunities for growth.

Of course, not all mergers and acquisitions are successful in achieving these goals. The key is for the management team to carefully consider the strategic rationale for the deal and then execute it flawlessly. If done right, a merger or acquisition can be a great way to build shareholder value.

What is it called when 3 companies merge?

Three companies merging is typically called a consolidation. In a consolidation, three separate companies combine into one. This can happen through a stock purchase, asset purchase, or a combination of the two. The end result is one company with three times the assets and employees of any one of the original companies.

The advantage of a consolidation is that it allows for economies of scale. The new, larger company can often operate more efficiently and effectively than the three smaller companies did on their own. A disadvantage is that a consolidation can often be disruptive to employee morale and business operations as everyone adjusts to the new structure and culture.

Why do so many mergers fail?

(Photo By Image by Gerd Altmann from Pixabay)

There are a number of reasons why mergers fail. One common reason is that the two companies are not compatible. This can be due to different corporate cultures, different management styles, or different business goals.

Another reason why mergers fail is that the two companies do not effectively integrate their operations. This can lead to duplication of effort, confusion among employees, and inefficiencies in the new company.

Finally, many mergers fail because the expectations of the shareholders are not met. This can be due to unrealistic projections, poor execution by management, or simply bad luck.

Whatever the cause, failed mergers are costly for both shareholders and employees. Shareholders lose money as the stock price of the new company declines, while employees often lose their jobs as the new company eliminates duplicate positions.

What happens to employees when companies merge?

When companies merge, the employees of both companies become employees of the new company. The new company is usually a joint venture between the two companies, and the employees are typically expected to work together to make the new company successful. In some cases, one company may buy another company outright, and the employees of the acquired company may be let go or given the option to work for the new company. In either case, it is important for employees to stay positive and cooperative during a merger, as it can be a difficult and stressful time for everyone involved.

How do you know if a merger is successful?

Ultimately, it comes down to whether or not the merged company is able to operate more effectively and efficiently than the two separate companies did previously. Are costs being cut without sacrificing quality or customer service? Are production levels increasing? Is the new company able to take advantage of economies of scale? If so, then the merger is likely considered successful from a business standpoint. Of course, there can be other factors at play as well, such as cultural compatibility between the employees of the two companies, which can impact long-term success.

Is Disney and Pixar a merger?

Disney’s acquisition of Pixar in 2006 was a merger of equals. The two companies had been working together for many years and had complementary strengths. The merger created a powerful force in the entertainment industry, with a combined portfolio of some of the most popular and iconic characters in the world.

What are examples of acquisitions?

There are many examples of acquisitions in the business world. One well-known example is when Apple Inc. acquired Beats Electronics for $3 billion. Another example is when Yahoo! Inc. acquired Tumblr for $1.1 billion.

What is the biggest merger ever?

The biggest merger ever was between Time Warner and AOL, which occurred in January 2000. The two companies had a combined market value of approximately $350 billion. The deal was largely seen as a success, although it has since been surpassed by other mergers.

Featured Image by naor eliyahu from Pixabay