Investors typically provide the capital needed for businesses to start or expand operations, whereas shareholders own shares in a company and receive dividends from any profits the business may generate.

What is an investor?

(Mohamed Hassan from Pixabay)

An investor is someone who puts money into a company or enterprise with the expectation of earning a financial return on their investment. The size of the financial return depends on the success of the enterprise and how well it performs.

What is a shareholder?

(Mohamed Hassan from Pixabay)

Shareholders, on the other hand, are owners of a company or enterprise. They may receive dividends (a portion of the company’s profits) as a return on their investment, but their main motivation for owning shares is to have a say in how the company is run. Shareholders may also be referred to as stockholders.

The difference between investors and shareholders

The most important difference between investors and shareholders is that investors are looking to make a profit, while shareholders are more interested in the stability of the company. For example, an investor might buy shares in a company because they believe the stock price will go up, while a shareholder might hold onto their shares because they want to be a part of the company’s success.

Another key difference is that investors can trade their shares on the stock market, while shareholders generally cannot. This means that investors can turn a profit much more quickly if the company’s stock price goes up, but they also risk losing money if the stock price falls. Shareholders, on the other hand, are more invested in the long-term success of the company and therefore are less likely to sell their shares.

Pros and cons of being an investor or shareholder

There are a few key differences between investors and shareholders. For one, shareholders are owners of a company, while investors merely provide capital to a company. This means that shareholders have voting rights and can have a say in how the company is run, while investors do not. Additionally, shareholders are typically more invested emotionally in the success or failure of a company than investors, who tend to be more detached.

That said, there are also some advantages to being an investor or shareholder. One is that you can make a lot of money if the company you invest in or own stock in does well. Another is that you have the potential to impact the direction of the company, especially if you are a shareholder. Finally, owning stock in a company can be seen as a badge of honour by some and can give you a sense of pride.

Is it better to be an investor or a shareholder

For starters, let’s look at commonalities. Both investors and shareholders are partial owners of a company and have a vested interest in its success. They also share some risk; if the company does poorly, both their investment and potential return diminish.

Now let’s look at how they differ. As an investor, you can choose to provide funding to a company through either debt or equity. Debt financing entails loaning money to a business with the understanding that the debt will be repaid with interest. Equity financing, on the other hand, is when you provide capital in exchange for an ownership stake in the company you’re buying shares of stock.

So, which is better? That depends on your goals as an investor or shareholder. If you want a fixed return on your investment with low risk, then debt financing might be right for you. But if you’re looking for higher potential returns—even if that means more risk—then investing in equity might make more sense.

Is every investor a shareholder?

(Mohamed Hassan from Pixabay)

Not every investor is a shareholder, though all shareholders are investors. Shareholders own a piece of the company they invest in, while investors simply bet on the success or failure of a company. An investor may lose everything if the company goes bankrupt, but a shareholder will only lose what they invested. Shareholders also have voting rights within the company and can elect board members.

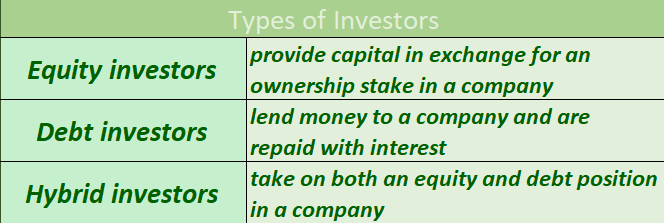

Each type of investor has different risks and rewards associated with their investment. Equity investors typically have the highest risk, but also the potential for the highest return. Debt investors have lower risk, but also lower potential returns. Hybrid investors fall somewhere in between these two extremes.

The type of investor that is right for your company depends on your specific needs and goals. If you are looking for long-term growth potential, equity investors may be the best fit. If you need short-term capital to fund operations or expand your business, debt investors may be a better option. If you are looking for a mix of both growth potential and stability, hybrid investing may be the way to go.

Who owns a shareholder?

A shareholder is an individual or company that owns shares in a corporation. Shareholders are typically motivated by the potential to earn a return on their investment through capital gains or dividends.

However, not all shareholders are created equal. Some shareholders may have more voting power than others, depending on the type of shares they own. For example, Class A shares typically confer more voting rights than Class B shares.

Majority shareholders – those who own more than 50% of the outstanding shares – have significant control over the direction of the company. They can elect the board of directors and make other decisions that affect corporate policy.

Minority shareholders – those who own less than 50% of the outstanding shares – generally have limited influence over corporate decision-making. However, they do have certain rights under state and federal law, such as the right to receive accurate and timely financial information about the company and to vote on major corporate transactions, such as mergers and acquisitions.

Can anyone be a shareholder?

There are two main types of shareholders: Common shareholders and Preferred shareholders.

Common shareholders have voting rights and receive dividends after preferred shareholders.

Preferred shareholders do not have voting rights, but they have priority when it comes to receiving dividends and assets if the company is liquidated.

To be a shareholder, you must purchase shares in a public company or invest in a private company that later goes public.

How do investors get paid?

When a company makes a profit, the shareholders receive a share of that profit. The amount of money each shareholder receives is based on the number of shares they own. For example, if a company has 100 shares and makes $100 in profit, each shareholder will receive $1.

Some companies also pay dividends, which are periodic payments to shareholders. Dividends are typically paid out of the company’s profits or from its reserves (money set aside for specific purposes). The amount of the dividend is determined by the board of directors and is usually a set percentage of the company’s profits.

So, investors get paid when the companies they’ve invested in make a profit and/or pay dividends.

What should you not tell investors?

Some things are better left unsaid when pitching your company to investors. Here are a few examples of what not to mention during your presentation:

-Your company’s current financial situation: if it’s not good, don’t bring it up. You don’t want to turn off potential investors before they’ve even had a chance to hear your pitch.

-How much money you need: this will come across as desperate and will likely turn investors away. Focus on what you can offer them instead.

-Your exit strategy: while it’s important to have one, this is not something you should share with investors upfront. They may view it as a lack of commitment on your part.

What percentage do investors take?

In general, shareholders are entitled to a portion of the company’s profits, through dividends and/or the appreciation of the stock price. Investors, on the other hand, usually don’t get paid until the company is sold or goes public. And when that happens, the investors – typically venture capitalists or angel investors – stand to make a much higher return on their investment than the shareholders.

So, what percentage do investors take? It depends – but it’s usually a lot more than 50%. It’s not uncommon for venture capitalists to own 70-80% of a startup company. That said, there are some circumstances where investors may only own a minority stake (e.g., if the company is getting funding from multiple sources).

Frequently asked questions about investors and shareholders

Can a shareholder be a CEO?

In short, yes – a shareholder can be a CEO. The CEO is the head of the company, and they’re responsible for its overall performance. They report to the board of directors, who are elected by the shareholders. So, while a shareholder can be a CEO, they don’t necessarily have the power to make all the decisions. The board of directors has ultimate authority over the company.

Who is the controlling shareholder?

The controlling shareholder is the one who owns the majority of shares in a company. This gives them control over the company’s direction and management. The controlling shareholder may be an individual, a group, or another company.

Can a shareholder sell his shares to anyone?

Yes, a shareholder can sell his shares to anyone. However, the shareholder may be subject to certain restrictions, such as a pre-emptive right or a right of first refusal, which would allow other shareholders to purchase the shares before they are offered to the public.

Featured Image By – InvestmentTotal.com – Flickr