A banker’s cheque is a special type of cheque that is issued by a bank on its behalf, rather than on behalf of a customer. A demand draft is very similar to a regular cheque, except that it is drawn on a different bank than the one that issued it.

What is a banker’s cheque?

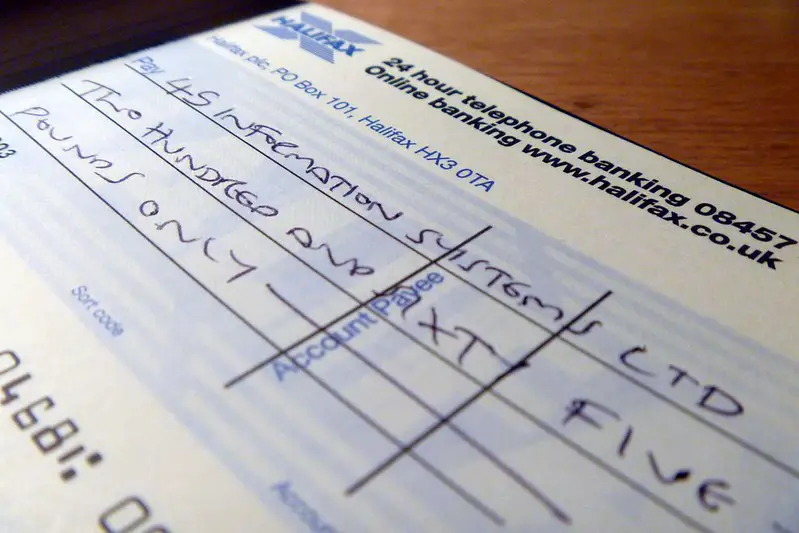

A banker’s cheque is a type of cheque that is guaranteed by a bank, which means that the funds are guaranteed to be available when the cheque is presented for payment. It is also known as a cashier’s cheque or bank draft.

To obtain a banker’s cheque, the account holder must first provide the bank with the funds needed to cover the cheque amount, along with any fees charged by the bank. Once the bank receives the funds, it issues a cheque drawn on its own account. The cheque is made out to the payee, and the payee’s name is printed on the cheque.

Banker’s cheques are typically used for large transactions such as purchasing a car or real estate, or for international transactions where the payee may not accept a personal cheque due to concerns about the validity of the funds or the security of the transaction. Because the funds are guaranteed by the bank, a banker’s cheque is considered to be a very secure form of payment.

One important thing to note is that banker’s cheques may have a hold period before the funds are available to the payee. This hold period allows the bank to verify the funds and ensure that there are no issues with the account or the transaction. The length of the hold period can vary depending on the bank and the amount of the cheque.

What is a demand draft?

A demand draft is a type of payment instrument that is similar to a banker’s cheque or a cashier’s cheque. It is a prepaid negotiable instrument that is issued by a bank, which guarantees that the amount stated on the draft will be paid to the payee on demand.

The process for obtaining a demand draft is similar to that of a banker’s cheque. The person who wants to make the payment (the remitter) goes to their bank and provides the bank with the details of the payment, including the name of the payee and the amount of the payment. The bank then deducts the amount of the payment, along with any fees, from the remitter’s account and issues a demand draft drawn on the bank’s own account.

The demand draft is made out to the payee and contains all the necessary details of the payment, including the name of the remitter, the amount of the payment, and the date of issue. The demand draft is then sent to the payee, who can present it to the bank for payment at any time.

Demand drafts are commonly used for making payments for services, making investments, or for making payments for international transactions. They are considered to be a safe and secure way of making payments, as the payment is guaranteed by the bank issuing the demand draft. However, it is important to note that demand drafts can take longer to clear than other forms of payment, and the payee may have to wait for a few days before the payment is available in their account.

Demand draft Vs. Bankers cheque – Key differences

Demand drafts and bankers cheques are both payment instruments that are issued by banks and are used to make payments. However, there are some key differences between the two:

Payment Method: A demand draft is a payment order, while a banker’s cheque is a payment instrument.

Issuer: A demand draft is issued by a bank on behalf of a customer, while a banker’s cheque is issued by the bank itself.

Guarantee: A demand draft is guaranteed by the issuing bank, while a banker’s cheque is guaranteed by the bank that issued it.

Payment: A demand draft is paid out of the account of the customer who requested it, while a banker’s cheque is paid out of the bank’s own funds.

Cost: The cost of a demand draft is typically lower than that of a banker’s cheque.

Use: Demand drafts are commonly used for making payments within a country or internationally, while banker’s cheques are commonly used for large payments such as real estate transactions or for international payments.

Time: Demand drafts usually take longer to clear than bankers cheques, as the issuing bank must verify the funds before the payment can be made, whereas bankers cheques are typically cleared within a few days.

While both demand drafts and bankers cheques are secure payment instruments issued by banks, demand drafts are typically used for smaller payments and are cheaper, while bankers cheques are used for larger payments and are more expensive.

When to use a bankers cheque/demand drafts?

Banker’s cheques and demand drafts are both secure payment instruments that are issued by banks and are commonly used for making payments. Here are some situations where you may want to use a banker’s cheque or demand draft:

Large Transactions: If you are making a large transaction, such as purchasing real estate or a car, a banker’s cheque or demand draft can provide a secure and reliable way to transfer funds.

International Payments: If you need to make an international payment, a banker’s cheque or demand draft can be a good option as they are typically accepted by banks and financial institutions worldwide.

Unfamiliar Parties: If you are making a payment to someone you do not know well or trust, a banker’s cheque or demand draft can be a safer option than a personal cheque or wire transfer.

Security: If you are concerned about the security of your payment, a banker’s cheque or demand draft can provide added security as they are guaranteed by the issuing bank.

Legal Requirements: In some cases, such as when paying court fees or making payments to government agencies, a banker’s cheque or demand draft may be required by law.

You may want to consider using a banker’s cheque or demand draft when making large transactions, international payments, or when you are concerned about the security of your payment. However, it’s important to note that there may be fees associated with these payment methods, and they may take longer to clear than other forms of payment.

The advantages and disadvantages of Bankers cheque and Demand draft

Advantages of Banker’s Cheques:

- Security: Banker’s cheques are considered to be one of the most secure payment instruments as they are guaranteed by the issuing bank.

- Accepted Everywhere: Banker’s cheques are accepted by most businesses and individuals, making them a widely accepted payment method.

- Convenience: Banker’s cheques can be obtained quickly and easily from your bank, making them a convenient option for making large payments.

- Record-Keeping: Banker’s cheques provide a paper trail that can be useful for record-keeping and auditing purposes.

Disadvantages of Banker’s Cheques:

- Cost: Banker’s cheques can be expensive, as they typically involve fees that are charged by the issuing bank.

- Time: Banker’s cheques can take longer to clear than other payment methods, which can delay the payment process.

- Availability: Some banks may require you to have an account with them in order to obtain a banker’s cheque.

Advantages of Demand Drafts:

- Security: Demand drafts are guaranteed by the issuing bank, making them a secure payment method.

- Widely Accepted: Like banker’s cheques, demand drafts are widely accepted by businesses and individuals.

- Convenience: Demand drafts can be obtained quickly and easily from your bank.

- Lower Cost: Demand drafts are typically less expensive than banker’s cheques.

Disadvantages of Demand Drafts:

- Time: Demand drafts can take longer to clear than other payment methods, which can delay the payment process.

- Limitations: Some banks may have limitations on the amount that can be paid using a demand draft.

- Exchange Rate: When making international payments, the exchange rate may be less favorable than other payment methods.

Banker’s cheques and demand drafts both have their advantages and disadvantages. They are both secure payment methods that are widely accepted, but they can be expensive and take longer to clear than other payment methods.

Featured Image By cottonbro